We are increasingly placing our trust in private healthcare

The taking out of private health insurance has grown by 8% during the pandemic years in a sector that must face up to new challenges such as digitalisation.

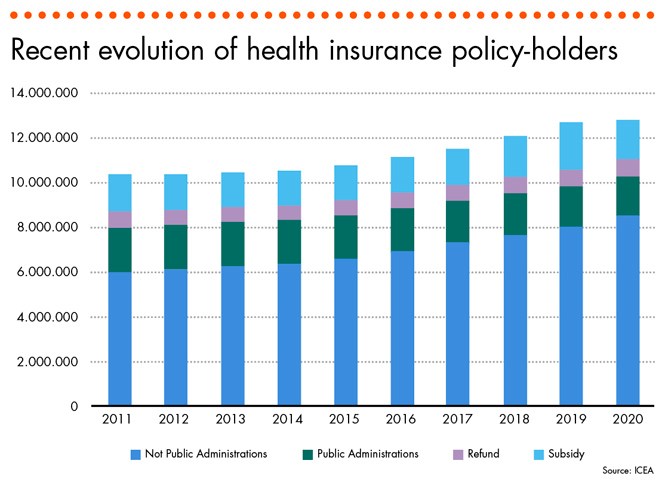

Our health concerns us a great deal. The pandemic has accelerated the taking out of private health insurance. Policies grew by 8% between the end of 2019 and December, 2021, which means around 1.3 million people opted for private healthcare, as can be deduced from the latest report by ICEA, ‘Health Insurance in December, 2021’.

Over these two years, the sector has faced up to enormous challenges such as the care for people with Covid-19, in spite of the fact that some polices excluded pandemics, which has contributed to position the sector as a good ally for citizens and has encouraged people to take out policies even more. The trends derived from digitalisation and the new technologies have also been speeded up: insurance companies have opted for telemedicine as a differentiating proposal and they have seen more online policies being taken out.

The coronavirus crisis has altered the lifestyle habits of policy-holders and health care has become one of the most relevant concerns all over the planet

Private health insurance policies have experienced a constant increase over recent decades and today, one in every four citizens has one. According to the study “Insurance and Pension Funds”, by the Ministry of Economic Affairs and Digital Transformation, at the close of 2020, 93 insurance entities were operating in the health area, closing the financial year with an invoicing volume of 9,255 million euros. The report emphasises the 4.41% increase in premiums compared to 2019 and it attributes this to the pandemic, but also to “the greater willingness of consumers to be increasingly more covered and protected on health aspects.” Additionally, according to ICEA, the lack of access to primary healthcare that occurred in 2021 due to the pandemic, added to the increase in waiting lists, have convinced citizens of the need to take out private health insurance. At present, in private hospitals they are already carrying out 37% of the surgical operations; they see 30% of the emergency cases and they take 26% of the medical consultations for Spanish healthcare. Additionally, the sector currently employs 360,000 professionals, in 458 hospitals, making up 58% of the total available in the country and the private sector has 32% of the hospital beds.

Another reason for the growth of this type of insurance policies has been the initiative by the insurance companies to protect healthcare professionals and care homes workers, who are working on the frontline in the fight against Covid-19, creating a solidarity fund to cover them. The taking out of group plans by small and medium-sized companies is also on the rise, a fact that has been unusual up to now in the case of SMEs, which have realised that offering their employees a health policy is a good way to make them loyal and a tool to retain talent. This is confirmed in a study by the digital platform Cobee, which indicates that 62% of employees show their preference for having a policy that provides them with healthcare cover.

Greater Saving

So much so that private insurance now makes up 7% of the total health benefits. With data from 2019, the employers’ association UNESPA calculates that the public system means approximately 71% of the total expenditure in health, to which must be added 22% that is assumed by the families for services that are not covered by public healthcare, such as glasses, for example. Additionally, according to the document ‘Private healthcare, contributing value: Analysis of the 2021 situation,’ prepared by the Institute for the Development and Integration of Healthcare, by the Fundación Idis, it estimates that the saving generated by private insurance would be between 506 euros, if public and private healthcare is used and 1,368 euros per year, in the case of patients who only use private healthcare.

The authors of the report by the Ministry of Economic Affairs and Digital Transformation affirm in their study that “the coronavirus crisis has altered the lifestyle habits of policy-holders in many aspects and healthcare has become one of the most relevant concerns all over the planet.” Additionally, the social distancing steps have meant that health insurance companies have had to introduce “new measures and to search for digital solutions in order to continue providing their healthcare services through new tools such as video consultations and telemedicine.” In fact, the experts confirm that the pandemic has been a “true catalyst for telemedicine,” and companies from the healthcare ecosystem have put the spotlight “more than ever on the transformation of their business model towards one that is more aimed at preventive, efficient healthcare through technology.” Before the pandemic, there were already insurance companies that offered digital insurance, but it wasn’t until 2020 and 2021 that they became standardised throughout society.

By provinces

Madrid and Barcelona are the leading provinces in private insurance policies, followed by Valencia, Seville and Malaga, according to data from the report ‘Health insurance in the year 2020,’ by UNESPA.

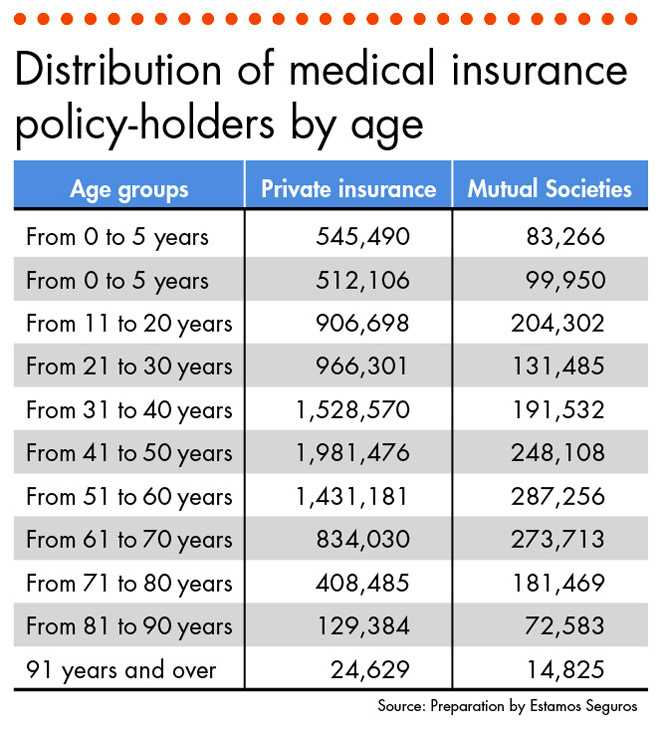

And by ages, people aged from 41 to 50 years are the ones who have most insurance policies, 21.38% of the total. Compared to Europe, Spain continues to be in the middle of the list regarding the adoption of private insurance, according to data from Eurostat. Specifically, it holds position number 15, after Cyprus and before the Czech Republic, but along way behind countries where this cover is very generalised, such as the Netherlands, Belgium, Slovenia and France, with rates of over 75%.

Types of insurance

For healthcare. They provide, in exchange for the payment of the price of the insurance, access to a closed set of healthcare services without any extra cost than the payment itself, according to the employers’ association UNESPA.

For the refunding of medical expenses. They include the possibility for the policy-holder to be able to make use of the healthcare service of their choice and subsequently, the insurance company refunds a percentage of the aforementioned payment.

For subsidies. This compensates the policy-holder in the case that they must take sick leave, are hospitalised or due to any cause related to health.